Business overview / Marketing and sales

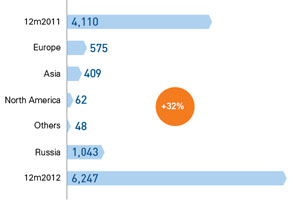

Aeroflot Group revenue from scheduled passengers

carriages (USD million)

The share of sales in Russia through the Transport Clearing House and BSP Russia rose from 31% in 2011 to

38%

in 2012, while Internet sales grew from 16% to 20%. At the same time, sales through official agents declined from 42% to 32%, and the share via the Company’s own sales offices fell from 11% to 10%.

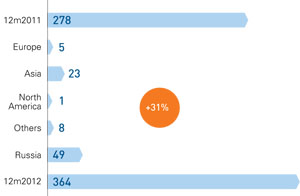

Aeroflot Group revenue from scheduled cargo carriages (USD million)

Passenger ticket sales

In 2012 Aeroflot continued to work on optimization and efficiency gains in its sales business.

Sales in Russia

The development of sales in Russia in 2012 was helped by ongoing work to optimize the structure of Aeroflot Group and integrate subsidiary airlines. Flights of Donavia and Vladivostok Air were shifted to full commercial management by Aeroflot, which significantly expanded presence on regional passenger markets and increased revenues generated in Russia by 54% in roubles (44% in US dollars) in comparison with 2011. The highest growth rates were seen at Company branches in the Russian Far East: sales grew by 146% in Khabarovsk and by 113% in Vladivostok. Aeroflot sales growth in 2012 was driven to a large extent by expansion of the Company’s route network. Direct and transit air traffic both increased, drawing additional passenger flows from destinations in Russia, Europe and Asia.

Passenger carriage services in Russia are sold through the following channels:

- neutral sale systems (Transport Clearing House, BSP Russia);

- official agents (companies that have direct agency agreements with Aeroflot);

- the Company’s Internet site;

- the Company’s own sales offices and call center.

Sales outside Russia

The market for air tickets outside Russia is highly consolidated: 20 countries account for about 79% of total sales abroad. The highest growth rates in 2012 were seen in Greece (by 111.0%), in Ukraine (by 98.3%), in Germany (by 62.4%), and in China (by 48.6%).

Aeroflot continued to integrate its sales system within the BSP and ARC global settlement systems in the reporting year. The Company expanded its presence and sales volumes in Azerbaijan and Indonesia after these countries joined the BSP, and continued to authorize agents for ticket sales in China.

Tickets are sold outside Russia through the following channels:

- the IATA agenсу network integrated into BSP and ARC settlement systems;

- official agents (companies that have direct agency agreements with Aeroflot);

- the Company’s Internet site;

- the Company’s own sales offices.

The Company continued to optimize its foreign sales channels, achieving substantial and consistent reduction in the share of sales via the Company’s own offices (the least efficient sales channel), which fell from 9% in 2011 to 6% in 2012. Passenger carrying is sold on foreign markets through 76 representative offices.

Cargo carrying sales

Aeroflot continued to develop sales in the cargo transportation segment in 2012. Aeroflot’s customers on this market include well-known international courier companies, such as DHL, TNT, DPD Armadillo and Pony Express. Aeroflot makes transit cargo shipments on a regular basis for JSC Sukhoi.

Aeroflot is a licensed customs carrier, which enables it to offer customers exclusive delivery services for cargo under customs control from foreign countries to Russia.

The Company sells cargo carrying services via electronic trading on the following routes:

- Moscow — Khabarovsk, Vladivostok, Petropavlovsk-Kamchatsky, Yuzhno-Sakhalinsk, Tyumen, Surgut, Kemerovo, Barnaul, Nizhnevartovsk, Novosibirsk, Omsk, Krasnoyarsk, Perm;

- Khabarovsk — Moscow, Vladivostok — Moscow.

Sales will be positively affected by further integration of subsidiary airlines into Aeroflot Group in 2013, and by work to boost ticket sales on new routes in Russia and abroad.

Direct sale of cargo services via the CASS (Cargo Agency Settlement System) offers great potential for increase of cargo business and of income from the business. CASS has been used since 2011 by companies from Northern Europe, Germany and the Czech Republic, as well as other countries. Turkey, China and Switzerland joined CASS in 2012 and a number of countries from Eastern and Western Europe and the Middle East plan to join in 2013.

Aeroflot is offering transportation of high-revenue cargo using Internal Customs Transit (ICT) as part of steps to enhance its sales system. Every month the customs clearance team of Aeroflot’s Cargo Transportation Department clears up to 450 transit cargo shipments in ICT mode through Sheremetyevo Airport. Further development of this activity is one of the Company’s priority tasks for 2013.