Business overview / Operations by airline subsidiaries and affiliates

Impressive consolidated operating results of Aeroflot Group in 2008–2012 reflect both organic growth and non-organic (M&A) expansion.

| Indicator |

Unit |

Aeroflot Group |

|

|

2008 |

2009 |

2010 |

2011 |

2012 |

2012/2011 |

| Passenger traffic |

million passengers |

11.6 |

11.1 |

14.1 |

16.4 |

27.5 |

67.6% |

| Available seat kilometers |

billion ASK |

43.9 |

42.6 |

50.8 |

60.0 |

95.6 |

59.3% |

| Revenue passenger kilometers |

billion RPK |

31.2 |

29.9 |

39.2 |

46.1 |

74.6 |

61.9% |

| Seat load factor |

% |

70.9 |

70.2 |

77.1 |

76.8 |

78.1 |

1.3 p.p. |

The process of integration of airline subsidiaries into the structure of the Group was continued in 2012, including unification of route networks, sales systems, construction of common marketing strategy, and implementation of unified financial policy and tax accounting rules.

OJSC Rossiya Airlines

The company is developing as a regional carrier based at Pulkovo Airport in St. Petersburg. Rossiya Airlines continued to optimize and coordinate its route network and timetable in 2012 within Aeroflot Group. The carrier gave up a number of loss-making routes, reducing its total number of routes from 120 to about 80. Merger of offices in Russian cities and abroad with existing Aeroflot offices continued in the reporting year and represents one of the key mechanisms for cost savings at the level of the Group. Rossiya Airlines improved the results of its operations with Аn-148 aircraft, reduced the number of different aircraft, which it operates (by withdrawal of Boeing B737s from the fleet) and optimized its personnel structure.

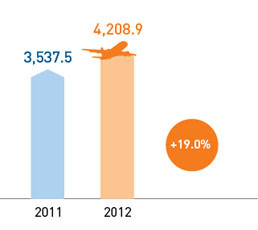

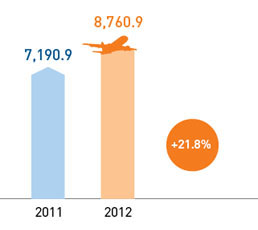

All of the company’s main operating indicators were improved in 2012: passenger traffic grew by 19% to 4,208,900, passenger turnover rose by 21.8% to 8,760.9 million PKM and passenger load factor increased by 2.2 p.p. to 77.5%.

Passenger traffic, thousand passengers |

Passenger turnover, million PKM |

Seat load factor, % |

|

|

|

|

JSC Donavia

JSC Donavia is a regional carrier based in Rostov-on-Don. The company transferred all of its commercial functions to Aeroflot in 2012, closing down its own commercial operations. Donavia has established a unified financial policy, tax accounting rules and sales accounting in line with Group standards and made its services conform with the Group’s “region” product standard. The fleet has been restructured and the company has designed a pilot project for centralization of development strategy functions for its service and maintenance division (centralization of the spare parts pool, and of engineering and quality management).

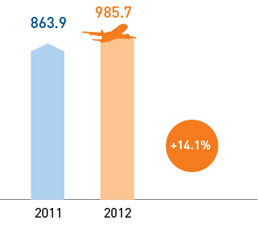

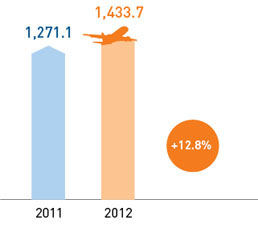

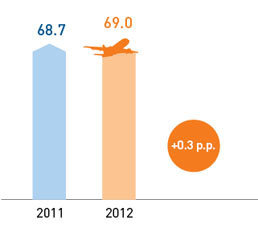

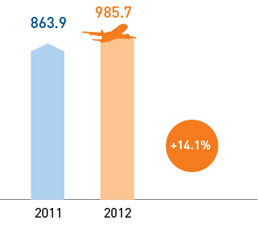

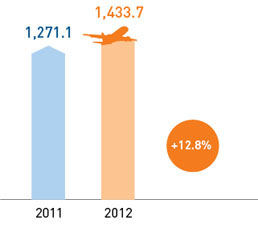

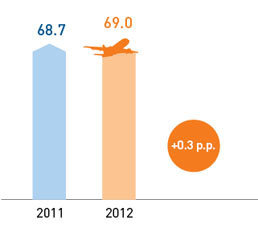

The company showed improvement of its main operating indicators in 2012: passenger traffic rose by 14.1% to 985,700, passenger turnover added 12.8% to 1,433.7 million PKM and seat load factor was 69.0% (0.3 p.p. more than in 2011).

|

|

|

Passenger traffic, thousand passengers

|

Passenger turnover, million PKM

|

Seat load factor, %

|

JSC ORENAIR

The business model of Orenair is focused on tourist carrying from Russian cities to the most popular tourist destinations: Turkey, Egypt and Thailand. The company improved its operating and financial efficiency in the reporting period, and the non-regular carrying programme of Orenair in Russia’s Southern Federal District was merged with that of Vladivostok Air in the Far East District. Work began on transfer of non-regular carrying by Rossiya Airlines to and from St. Petersburg to Orenair. The company has implemented a unified financial policy and tax accounting rules in line with other Aeroflot subsidiaries.

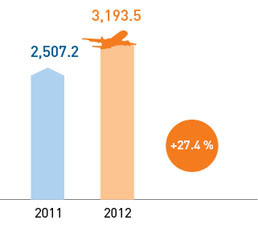

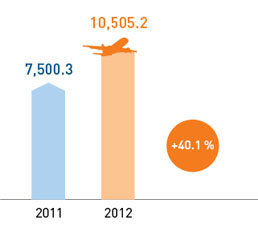

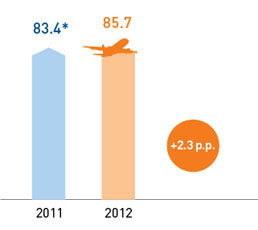

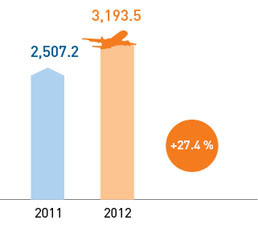

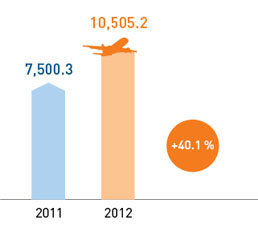

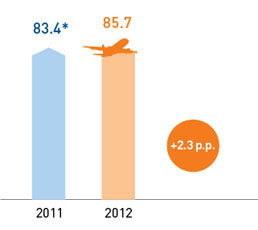

Operating results grew rapidly in 2012 thanks to operating efficiency gains. Passenger traffic rose by 27.4% to 3,193.5 million and passenger turnover reached 10,505.2 million PKM, which is 40.1% more than in 2011. Seat occupancy rose by 2.3 p.p. to 85.7%.

|

|

|

Passenger numbers, thousand

|

Passenger turnover, million PKM

|

Seat occupancy, (%)

|

JSC SAT Airlines

SAT Airlines completed the transfer of its commercial functions to Aeroflot Group in 2012 and also optimized its route network. The company has centralized its service and maintenance development strategy, spare parts pool, engineering and quality management. Unified Group financial policy and tax accounting rules have been adopted at SAT Airlines.

Operating results declined slightly in 2012 due to optimization of company business as part of Aeroflot Group.

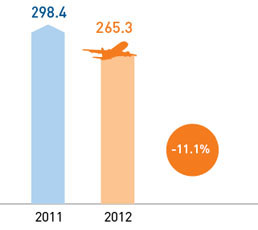

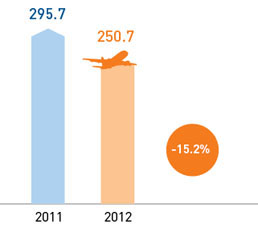

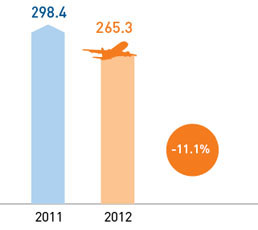

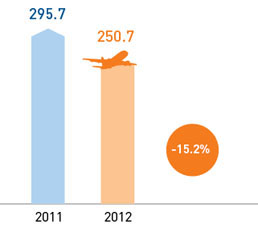

Measures for improvement of operating and financial efficiency led to reduction of passenger traffic at SAT Airlines by 11.1% to 265.3 million in 2012. Passenger turnover declined by 15.2% to 250.7 million PKM and passenger load factor was 60.0% (2.0 p.p. lower than in 2011).

|

|

|

Passenger traffic, thousand

|

Passenger turnover, million PKM

|

Seat load factor, %

|

JSC Vladivostok Air

Commercial functions were transferred from Vladivostok Air to Aeroflot Group in 2012, the company optimized its route network and tickets for Vladivostok Air flights were sold through Aeroflot offices. A legal scheme for settlements between Aeroflot and Vladivostok Air for charter flights was put in place. The company took responsibility for ground handling of Aeroflot flights in Vladivostok and Khabarovsk and integrated its service and maintenance development strategy, spare parts management, engineering and quality management at the level of the Group. The Vladivostok Air fleet was optimized by withdrawal of Yak-40, Мi-8 and Airbus А330 aircraft.

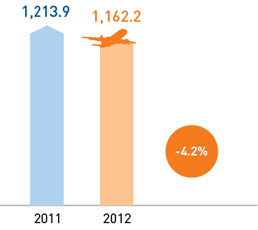

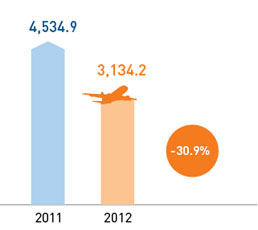

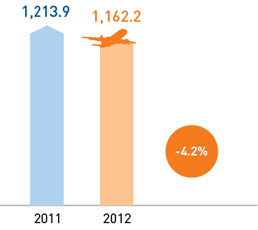

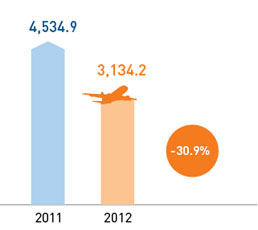

Operating and financial results in the reporting period saw a decline compared with 2011 due to steps taken in 2012 to integrate company operations with those of the Group and to improve operating efficiency (including optimization of the number of aircraft in the company fleet). The return of several aircraft operated under lease agreements ahead of schedule led to lower sales and revenue results and the company was subject to a number of unplanned non-recurring costs (fine for early return of aircraft, overhaul costs, etc). The company borrowed money in order to meet these costs, and the borrowings contributed to a net loss in the reporting period. Passenger traffic of 1,162.2 million was 4.3% less than in 2011, and passenger turnover fell by 30.9% to 3,134.2 million PKM. Seat load factor was 67.3%, which is 3.6 p.p. less than in 2011.

After the reporting period (in March 2013) a 52.156% share stake in Vladivostok Air, belonging to JSC Aeroflot, was transferred to ownership by SAT Airlines as part of the programme for creation of a united Far East airline.

|

|

|

Passenger traffic, thousand

|

Passenger turnover, million PKM

|

Seat load factor, %

|

Sale and purchase contracts in 2012 for shares / participatory stakes of non-core companies

| Object of the transaction |

Aeroflot stake prior to sale |

Transaction value (roubles) |

| Sale and purchase of 50% (fifty percent) of the charter capital of JSC Airport Moscow |

50% |

109,380,000.00 |

| Sale and purchase of 200 common shares of CJSC Aerofirst |

66.66% |

1,230,000,000.00 |