Securities / Share capital

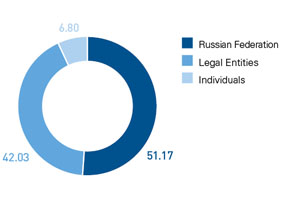

Structure of share capital

Charter capital of JSC Aeroflot as of December 31, 2012 amounted to RUR 1,110,616,299, consisting of 1,110,616,299 common registered uncertified shares with par value of 1 ruble. The Company does not have preferred shares.

State registration numbers of Aeroflot common share issues are: 73-1p-5142 (dated June 22, 1995); and 1-02-00010-А (dated February 1, 1999). The issues were united by Decree № 04-168/p of the Federal Securities Commission, dated January 23, 2004, as a result of which the issues of Aeroflot common shares were given state registration number 1-01- 00010-А, dated January 23, 2004.

In addition to shares outstanding, the Company has the right to issue a further 250 million common shares (authorized shares). No additional shares were issued in 2012.

The total number of shareholders of Aeroflot on December 31, 2012 was 10,881 (29 legal entities and 10,852 individuals), compared with 10,946 on December 31, 2011 (30 legal entities and 10,916 individuals).

The register of shareholders of JSC Aeroflot is kept by CJSC Computershare Registrar (License № 10-000-1-00252). Details of the register holder are given in the “Contacts” section at the end of this Report.

Information on main shareholders of JSC Aeroflot as of December 31, 2012

| Holders |

Status |

As of 31.12.2011 |

As of 31.12.2012 |

Change of stake in share capital, percentage points |

| Number of shares |

Stake in share capital, % |

Number of shares

| Stake in share capital, % |

| Legal entities of which: |

|

1,033,827,304 |

93.09 |

1,033,827,304 |

93.18 |

+0.09 |

| Russian Federation (through the Federal Agency for State Property Management) |

O |

568,335,339 |

51.17 |

568,335,339 |

51.17 |

— |

| CJSC National Settlement Depository |

N |

166,261,161 |

14.97 |

294,542,434 |

26.52 |

+11.55 |

| CJSC Depository Clearing Company |

N |

127,448,041 |

11.48 |

— |

— |

— |

| LLC Aeroflot-Finance |

O |

65,913,307 |

5.93 |

49,690,915 |

4.47 |

-1.46 |

| LLC Aviacapital-Service |

O |

— |

— |

22,688,599 |

2.042 |

+2.042 |

| Russian Technologies State Corporation |

O |

39,409,323 |

3.55 |

16,720,724 |

1.51, |

-2.04 |

| CJSC ING Bank (Eurasia) |

N |

23,293,258 |

2.10 |

46,820,781 |

4.22 |

+2.12 |

| LLC Deutsche Bank |

N |

18,997,000 |

1.71 |

19,014,800 |

1.71 |

— |

| CJSC Citibank |

N |

10,115,220 |

0.91 |

13,476,959 |

1.21 |

+0.3 |

| LLC J.P. Morgan Bank International |

N |

8,871,168 |

0.80 |

3,589,507 |

0.32 |

-0.48 |

| JSC Aeroflot Russian-Airlines |

O |

4,472,711 |

0.40 |

— |

— |

— |

| CJSC UniCredit Bank |

N |

614,050 |

0.055 |

147,400 |

0.013 |

-0.042 |

| Individuals |

|

76,788,995 |

6,91 |

75,492,115 |

6,8 |

-0,11 |

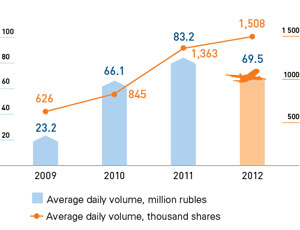

Average trading volumes on the Moscow Exchange

Aeroflot shares, depositary receipts and bonds are traded on the stock market. The Company’s common shares and exchange bonds are traded on the Russian stock market, and global depositary receipts (GDRs) issued on Aeroflot common shares are traded on foreign markets.

Shares of Aeroflot are traded on the Moscow Exchange, where as at December 31, 2012 they are included in the A1 (highest) listing under the AFLT ticker and trade in the main section as well as in the Classica and Standard sections of the market. Aeroflot shares are included in the main Russian stock indexes: MICEX, MICEX MC (standard cap share indexes) and the RTSI and RTS2 (“second-tier” index).

There was further growth of Aeroflot shares trading volumes on the Moscow Exchange in 2012, when volumes rose by more than 11% in comparison with 2011, from a daily average of 1.364 million to 1.508 million shares.

Maximum and minimum market price per share

| |

2012

| 2011 |

2010 |

2009 |

2008 |

| Maximum, roubles |

55.85 |

81 .8 |

84.86 |

52.92 |

108.33 |

| Minimum, roubles |

30.03 |

44.23 |

50.96 |

20.13 |

27.38 |

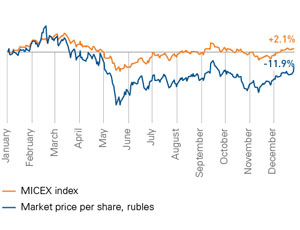

Aeroflot share price and the MICEX index in 2012 (%)

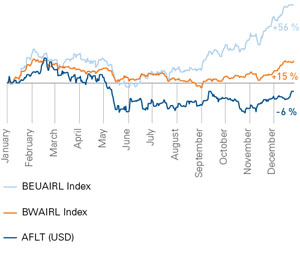

Aeroflot share price and Bloomberg airline indexes in 2012, %

Company capitalization as of December 31, 2012 was RUB 50.34 billion (USD 1.65 million), which is 9.9% less than on December 31, 2011 (the decline in USD terms was 5.2%).

2012 was a challenging year for the European share markets, including the air transport sector. Prices for Company shares were much influenced throughout the year by macroeconomic factors (economic instability and aggravation of the debt crisis in Europe). The Company’s financial indicators and capitalization indicators were also negatively impacted by rising prices for aviation fuel.

The market was naturally cautious regarding substantial changes in the structure of the Group and acquisition of airline assets with varying development levels and market positions. Changes in corporate structure on such a large scale often exert additional pressure on a company’s financial position and, following this logic, many analysts lowered their forecast for Aeroflot’s financials in 2012. However, actual operating and financial results for the year show that the Company successfully integrated new assets while improving its operating performance and maintaining a strong financial position. Medium- and long-term synergies from the asset merger will help Aeroflot to expand its market presence and improve its financial indicators, having positive impact both on the overall business and on market ratings.

Reduction of capitalization in 2012 was also partly due to apprehensions about impact on Aeroflot’s operating and financial indicators from the liberalization of international routes in May-June 2012. However, a significant decline of the Company share price in May-June 2012 was followed by relative stability in the rest of the year. Corporate news in the second half of 2012 did not cause any significant fluctuations in the share price. The market welcomed the decision, made in 2012, to pay dividends for 2011. The dividends of RUB 1.8081 per share were 67% higher than for 2010, and this helped to increase Aeroflot’s investment appeal.

Aeroflot shares are traded outside Russia via global depositary receipts (GDRs) at the over-the-counter section of the Frankfurt Stock Exchange. One GDR represents 100 common shares. Deutsche Bank Trust Company Americas acts as depository bank and LLC Deutsche Bank is the custodian. A total of 19,014,800 shares were converted into GDRs as of December 31, 2012, representing 1.71% of Charter Capital.

Preliminary work was carried out in 2012 to change the number of shares per GDR to 5:1 in order to achieve higher GDR liquidity (this initiative will be completed in 2013) and also to implement a programme of American depositary receipts (ADRs) in order to simplify investments in Aeroflot for American investors.

GDR details

| Programme type |

Sponsored Level-1 Global Depositary Receipts (GDRs) under Regulation S and Rule 144а |

| Ratio (shared: GDR) |

100 : 1 |

| Ticker |

AERZF, AERAY |

| ISIN |

US0077712075, US0077711085 |