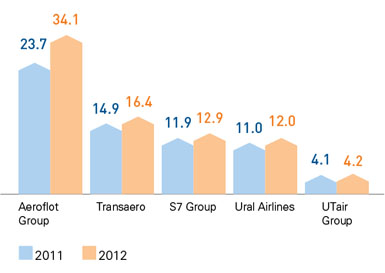

The Russian airline industry had a successful year in 2012, in contrast with peers in EU countries. Strength of the business of Aeroflot Group and other airlines in the Russian Top 5 (Transaero, UTair and S7) had positive impact on overall development of the national industry. The share of the Russian industry leaders in total passenger carrying on domestic routes grew from 56.8% to 72.1% year-on year, testifying to the consolidation, which is occurring on the Russian market.

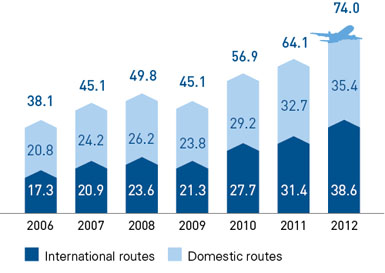

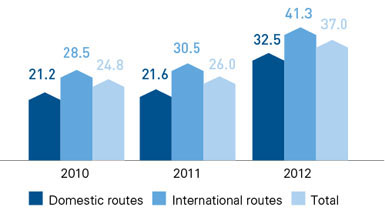

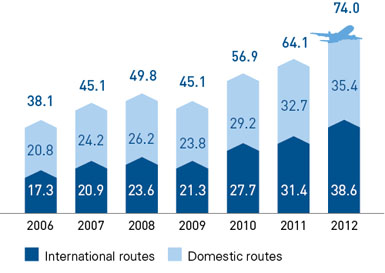

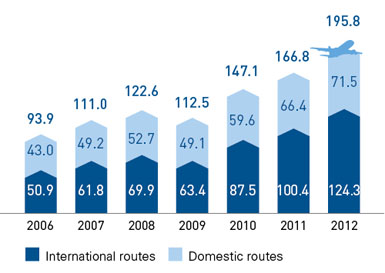

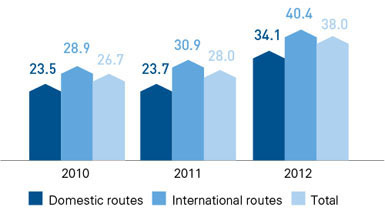

Russian airlines showed growth rates ahead of the overall market (domestic carrying and international routes to and from Russia). Size of the market including passengers carried by foreign companies grew by 14.5% to 92 million, while growth excluding foreign carriers was 15.5% to 74 million passengers (carrying by non-Russian companies rose by only 10.6%). There are several reasons for this development. On the one hand, it is due to a cautious approach by foreign companies in providing additional carrying capacities on routes to and from Russia. But it also reflects competitiveness of several Russian airlines, which has enabled them to win a greater share of passenger flows.

The share of international routes in total passenger carrying on the Russian market continued to grow in 2012, reaching 52.2% of total market volume. Carrying by Russian airlines on international routes increased by 7.3 million passengers y-o-y in 2012. The growth was led by Aeroflot, but several other companies (Transaero, S7 Group, UTair Group, Ural Airlines and Kogalymavia, which operates under the TUI brand) also made strong progress.

Growth of the total share of passengers carried on international routes was accompanied by a slowdown in rates of growth of passenger numbers on domestic routes in 2012. Growth of passenger numbers on domestic routes in 2012 was 8.1% to a level of 35.4 million passengers.

There is large potential for growth of domestic carrying, but it continues to be held back by excessive concentration of traffic at Moscow airports, which account for 75% of domestic passenger numbers. This state of affairs is expected to change in the medium term: international experience suggests that growth of business activity in regional centers will be of crucial importance for expansion of the domestic air transport market.

Passenger Traffic of Russian Civil Aiation

(million passengers)

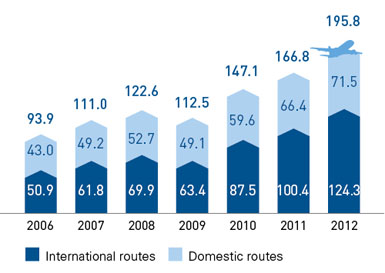

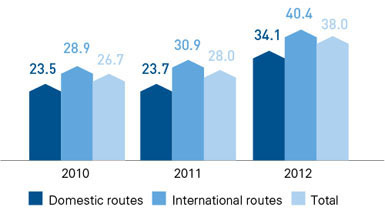

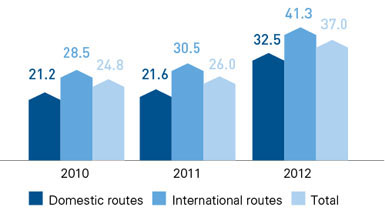

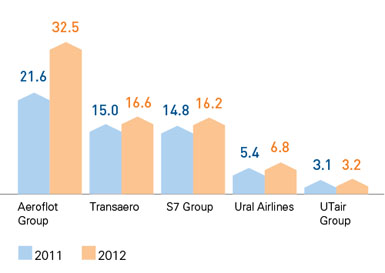

Passenger Turnover of Russian Civil Aviation

(billion PKM)

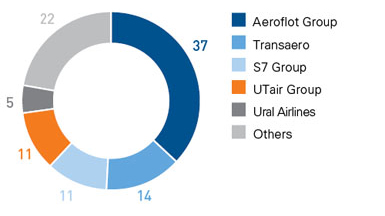

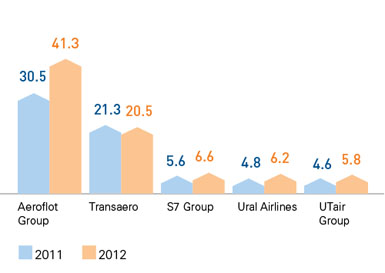

Aeroflot Group continued to expand its market presence, using a brand strategy to strengthen its position in various segments.

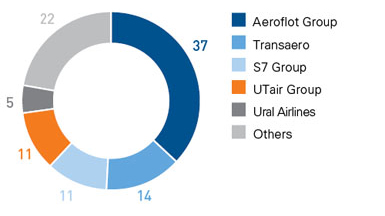

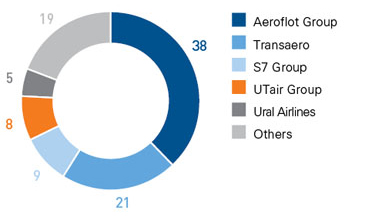

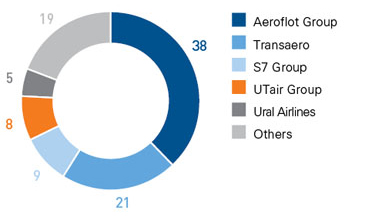

Following the consolidation in November 2011 of the airline assets of State Corporation Rostec, the share of Aeroflot Group in total Russian passenger traffic rose from 26% in 2011 to 37% in 2012 (by 11 percentage points) and its share of passenger turnover rose from 28% to 38% (by 10 percentage points).

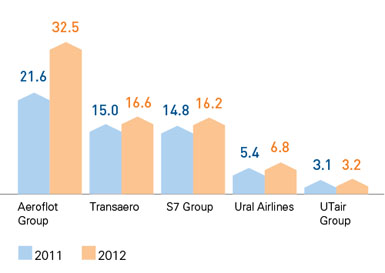

Structure of the Russian Air Transportation Market by Passenger Traffic

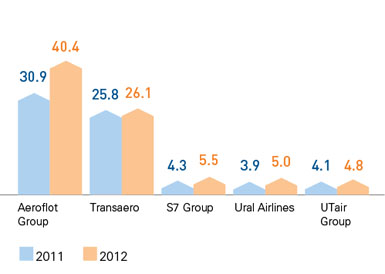

Structure of the Russian Air Transportation Market by Passenger Turnover

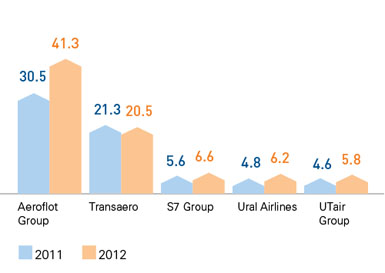

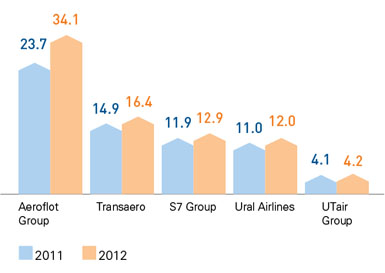

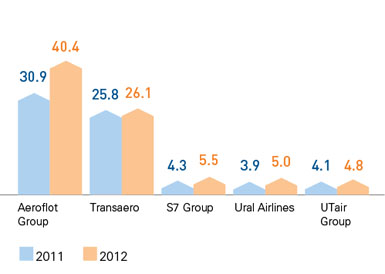

Share of Aeroflot Group on the Russian Air Transportation Market by Passenger Traffic

Share of Aeroflot Group on the Russian Air Transportation Market by Passenger Turnover

Rates of growth of passenger traffic and passenger turnover shown by Aeroflot are substantially higher than for the Russian industry as a whole. Passenger turnover of Aeroflot Group in 2012 was 74.6 billion passenger-kilometers (PKM), representing an increase of 61.9% y-o-y, and the number of passengers carried rose by 67.6% to 27.5 million. Respective advances by the overall Russian air transportation industry were 17% and 15%.

Structure of the Russian Air Transportation Market by Passenger Traffic on International Routes

Structure of the Russian Air Transportation Market by Passenger Traffic on Domestic Routes

Passenger turnover of Aeroflot Group in 2012 was 74.6 billion passenger-kilometers (PKM), representing an increase of 61.9% y-o-y.

Number of passengers carried rose by 67.6% to 27.5 million.

Structure of the Russian Air Transportation Market by Passenger Turnover on International Routes

Structure of the Russian Air Transportation Market by Passenger Turnover on Domestic Routes